USD exchange rate today 01/22/2025: USD decline brings mixed messages on tariffs and highlights market concerns about trade policy.

USD exchange rate today 01/22/2025

At the time of survey at 5:00 a.m. on January 22, the central exchange rate at the State Bank is currently 24,336 VND/USD, down 5 VND compared to yesterday’s trading session.

Specifically, at Vietcombank, the USD exchange rate is 25,060 – 25,450 VND/USD, down 50 VND in both buying and selling compared to yesterday.

VietBank is buying USD cash at the lowest price: 1 USD = 24,130 VND

VietBank is buying USD transfers at the lowest price: 1 USD = 24,150 VND

LPBank and OceanBank are buying USD cash at the highest price: 1 USD = 25,222 VND

VietinBank is buying USD transfers at the highest price: 1 USD = 25,549 VND

TPB Bank is selling USD cash at the lowest price: 1 USD = 24,870 VND

OCB Bank is selling USD transfers at the lowest price: 1 USD = 25,405 VND

Saigonbank is selling USD cash at the highest price: 1 USD = 25,552 VND

SeABank is selling USD transfers at the highest price: 1 USD = 25,530 VND

USD exchange rate today, January 22, 2025 on the world market

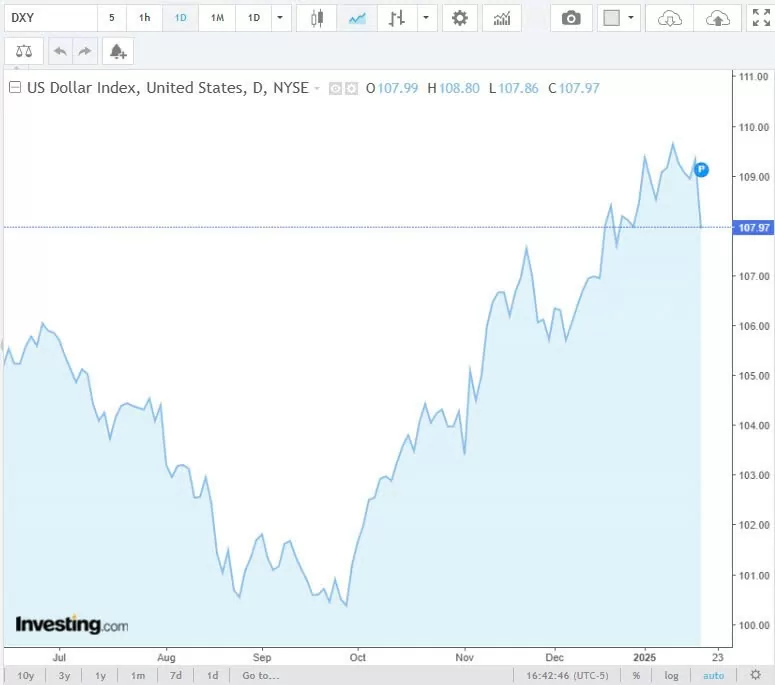

The Dollar Index (DXY), measuring the USD against 6 major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 107.97 – down 0.12 points compared to the transaction on January 21, 2025.

The dollar rose after falling sharply the previous day as Donald Trump’s return to the White House delivered mixed messages on tariffs and highlighted market concerns over trade policy.

The Canadian dollar and Mexican peso were among the hardest hit by the market volatility after Trump said he was considering imposing 25% tariffs on neighboring countries as early as Feb. 1.

However, some investors were still relieved that Trump did not announce a more comprehensive round of tariffs at the start of his second term, and that helped push down the yield on the benchmark 10-year Treasury note.

“Markets are still digesting the flurry of executive orders issued by Trump, but overall there is a sense of relief,” analysts at TD Securities said in a note.

The MSCI World Index of stocks rose 0.7%, with U.S. stocks mostly higher. The S&P 500 (.SPX) added 0.9%, the Nasdaq (.NDX) rose 0.6% and the Dow Jones (.DJI) rose 1.2%.

The dollar’s rise sent the Mexican peso sliding more than 1% earlier, while the Canadian dollar fell to a five-year low of $0.689, although the sell-off later eased somewhat.

Jan Von Gerich, chief strategist at lender Nordea, said investors should not assume that U.S. tariffs have been completely avoided.

“We shouldn’t get too hung up on this, the fact that he didn’t start with tariffs doesn’t mean they won’t come later,” he said. “For global equities, I think everything right now is about Trump.”

European shares edged lower after Asia rose slightly overnight, as investors and governments took comfort that the European Union and China have now avoided tariffs.

The pan-European STOXX 600 index (.STOXX) was up 0.4%, while MSCI’s broadest index of Asia shares outside Japan (.MIAPJ0000PUS) added 0.3%.

The dollar index, which measures the greenback against a basket of six peers, was flat at 108.01.

It had earlier risen to 108.79, although it failed to recover from Monday’s 1.2% drop in its biggest daily loss since November 2023.

The euro ended the session steady at $1.04200, after rising 1.42% the previous day.