Oil prices rose slightly in yesterday’s trading session (February 17) after an attack on a pumping station on an oil pipeline in the Caspian Sea.

Global commodity markets were quiet on the US President’s Day holiday. In the energy market, attacks on Russian oil pipelines pushed oil prices up slightly yesterday. Meanwhile, metals were mixed due to concerns about new US tax policies and a less optimistic economic outlook in China.

Oil prices fluctuate slightly on supply concerns

Oil prices rose slightly in trading yesterday (February 17) after an attack on a pumping station on an oil pipeline in the Caspian Sea, potentially slowing the flow of oil from Kazakhstan to the world.

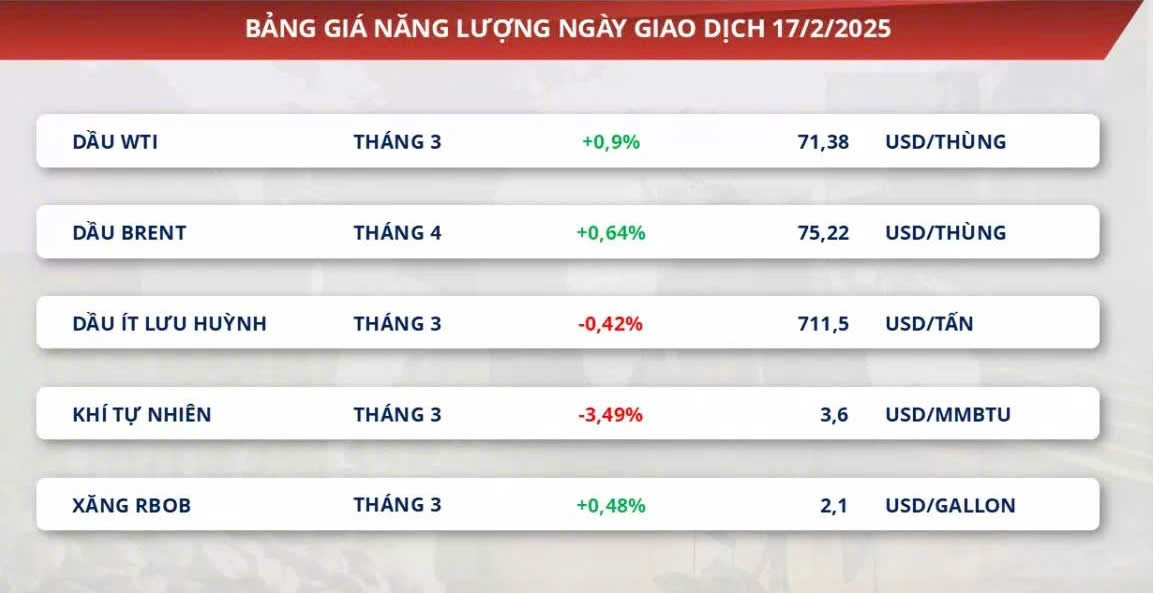

The oil market closed early yesterday. As of 2:30 a.m. on February 18, WTI crude oil prices were at $71.38/barrel, up 0.9%. Meanwhile, Brent crude oil prices rose 0.6% to $75.22/barrel.

The Caspian Pipeline Consortium said there had been a drone attack on the Kropotkinskaya pipeline pumping station in Russia’s southern Krasnodar region, reducing oil flows from Kazakhstan to world markets. While the attack severely affected Russian exports, investors feared that the escalation of the conflict could lead to more attacks, disrupting oil supplies to the world via the Caspian Sea.

The attack came as the US and Russia were pushing for a meeting in Saudi Arabia to discuss ending the war in Ukraine. If the war ended, sanctions on Russia would be lifted, and Brent crude could fall by $5-$10 a barrel.

In fact, the International Energy Agency (IEA) said Russian oil exporters had found new ways to circumvent US and EU sanctions and continue shipping oil abroad. Not only that, the IEA also estimated that Russia’s oil production in January was 100,000 barrels per day higher, reaching a total of 9.2 million barrels per day. The IEA has had to adjust its estimate of Russia’s oil production several times. This unofficial supply has helped stabilize oil prices in recent times.

Another piece of information that has dampened oil’s gains is that the USD index is hovering near a two-month low, as US retail sales in January fell the most in nearly two years, down 0.9%. In December 2024, retail sales increased 0.7%. Core retail sales in January fell 0.8%.

Limiting oil’s gains is the prospect of a possible global trade war after Trump ordered trade and economic officials last week to study reciprocal tariffs for countries that impose tariffs on US goods.

In addition, information from the Organization of the Petroleum Exporting Countries and its allies, including Russia, said that the group will continue to increase monthly oil supplies, expected to start in April. This will make the oversupply situation in the market more serious.

Metal market moves differently

On the first trading day of the week, the market witnessed a divergence in the metal group. The main reason came from concerns about new US tax policies and the less optimistic economic outlook in China.

In the trading session on February 17, the price of silver closed early at $32.88/ounce, up 0.06%, up 9% compared to the same time in January. Meanwhile, the price of platinum was at $1,007/ounce, down about 1.17%.

Concerns about global trade uncertainty continue to support silver prices to maintain their upward momentum. Last week, US President Donald Trump announced plans to impose tariffs on imported cars starting April 2. Last year, the US imported $471 billion worth of cars, with Mexico accounting for the majority at $49 billion. Currently, Mexico, Canada and South Korea are exempt from tariffs on the condition that they meet the rules of origin of goods in free trade agreements signed with the US.

In addition, since the end of November, silver inventories at the Chicago Mercantile Exchange (CME) have increased by 22%, reflecting the demand for silver in the US amid rising tensions. However, the price of the precious metal is also facing pressure from the forecast that the US Federal Reserve (FED) will not cut interest rates in March. This is due to the stable labor market and high inflation. High interest rates have pushed up US bond yields, attracting capital flows to the USD, thereby reducing the attractiveness of precious metals.

On the base metals side, COMEX copper closed early down about 1.6% to $10,119/ton. Meanwhile, iron ore prices also closed slightly down 0.31% to $106.46/ton.

The latest data from the People’s Bank of China (PBOC) showed that Chinese banks disbursed 5.13 trillion yuan (about $706.40 billion) in new loans in January 2025, up four times from the previous month and far exceeding the forecast of 4.5 trillion yuan. However, the total outstanding loan balance in 2024 will only reach 18.09 trillion yuan, down sharply from 22.75 trillion yuan in 2023. This figure reflects the cautious sentiment of both businesses and consumers amid economic uncertainty.

In addition, as the February LME copper contract expires this week, copper prices have risen sharply over the weekend due to the closing or rolling of positions to the next month. However, after the process is completed, buying power has weakened and selling pressure has increased, so the general selling sentiment has put pressure on the March COMEX copper price.

For iron ore, trading prices have decreased after major export ports in Australia resumed operations following Tropical Storm Zelia, helping to dispel supply concerns. In addition, China’s decision to impose a 15% tariff on coal imports from the US has pushed up steel production costs, which could lead to mills cutting production and reducing demand for iron ore.