Closing, WTI oil price fell below 60 USD/barrel, stopping at 59.58 USD/barrel, down 1.85%. Brent oil price fell 2.16%, down to 62.82 USD/barrel.

Red continued to dominate the world raw material price list in yesterday’s trading day (April 8)

The energy group led the decline of the entire market, the price of two crude oil products plunged to the lowest level in 4 years; meanwhile, the agricultural product market had a special trading session when 6 out of 7 products increased in price.

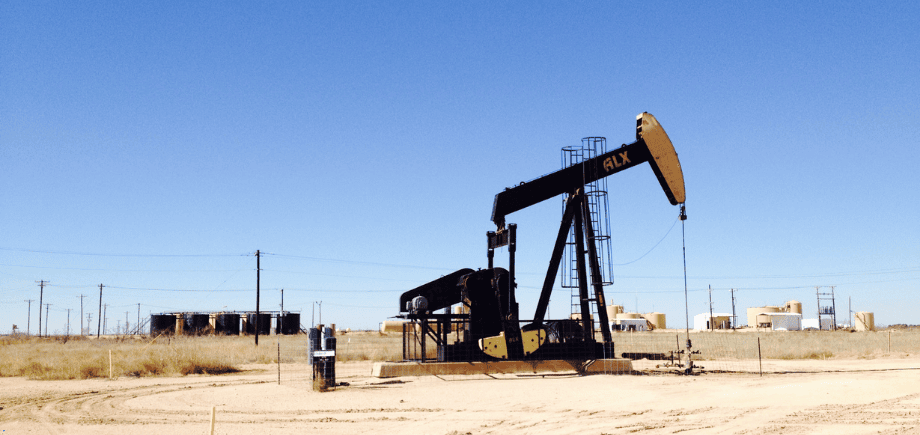

Energy market declines: Oil price falls below 60 USD/barrel

The energy market continued to be “tense” in yesterday’s trading session. Except for low-sulfur oil, all other products continued to be “red”. Oil prices have weakened for the fourth consecutive session as concerns about a global recession increase amid escalating US-China trade tensions.

At the close, WTI oil prices fell below the $60/barrel threshold, stopping at $59.58/barrel, down 1.85%. Brent oil prices also recorded a decrease of 2.16%, down to $62.82/barrel.

As soon as the market opened, many positive signs appeared with the market up, including energy, thanks to the prospect of new trade agreements between the US and partners such as Japan and South Korea.

However, this recovery did not last long when the White House confirmed that it would impose tariffs of up to 104% on imported goods from China. The tariff package includes three parts: the 20% tax that was previously applied, the 34% reciprocal tax issued by the US last week, and the additional 50% tax as Mr. Trump’s latest threat on April 7. China immediately strongly opposed this move and warned of retaliatory measures.

Previously, on April 4, Beijing announced a 34% tariff on imported goods from the US along with several other trade barriers. The European Union (EU) is also considering a 25% tariff and Canada will also impose a 25% tariff on some imported vehicles from the US effective tomorrow, April 10.

The gloomy outlook for the world economy is putting pressure on the future demand outlook for oil. This pressure is even greater after US President Donald Trump signed a series of new executive orders yesterday to promote coal mining, competing for market share with other sources such as crude oil, natural gas and renewable energy sources.

Many oil price forecasts have been published recently, with most predictions leaning towards a further decline. According to Societe Generale, WTI oil prices could fall to $57/barrel by the end of the year, while Goldman Sachs even believes that Brent oil prices could reach $40/barrel in some cases.

On the other hand, according to data from the American Petroleum Institute, crude oil inventories in the country are showing a downward trend. Accordingly, crude oil reserves decreased by 1.057 million barrels in the working week ending April 4, in contrast to an increase of 6 million barrels in the previous week.

Soybean prices rise, reflecting optimistic market sentiment

The agricultural market had a trading session that went against the general trend of the whole market yesterday. At the close, soybean prices recorded an increase of nearly 1%, reflecting the optimistic sentiment from investors. In terms of trading contracts, the May contract increased while the November contract decreased slightly. The “bull spread” trend (near-month contracts increased more than the far-month contracts) continued to be maintained, reflecting that the demand for the old crop is still very strong in the short term.

In contrast, the new crop contract is under pressure due to the risk of year-end exports, despite the lower expected planting area. Notably, the new crop soybean-corn price ratio has dropped to a record low of 2.19. This suggests that the US may consider switching planting area from soybeans to corn if time permits, causing the US soybean planting area in the current crop year to be lower than the latest forecast of the US Department of Agriculture (USDA).

An important reason for the price support yesterday was the positive impact of the new US tariff policy starting to show its effectiveness as important trading partners are reopening negotiations with the US. However, the increase has been somewhat limited by the fact that China – the largest trading partner – has not yet made any moves to cooperate in removing the current retaliatory tariffs of 34%. The US government has responded by officially applying tariffs of up to 104% on imported goods from China. The decision capped the gains in soybeans during the session.

For soybean products, soybean meal prices continued to recover from their lowest levels in nearly five years. In contrast, soybean oil prices fell for a fourth consecutive session despite receiving positive support from the proposed US biodiesel blending limit of 5.25 billion gallons, lower than expected but still 64% higher than current levels. Notably, the market did not react strongly to the news that Chinese used cooking oil could be included in the list of goods subject to a 104% tariff.