Domestic hot-rolled steel (HRC) may increase its market share to 60% from 32% in 2024

Hot-rolled steel (HRC) will have many fluctuations in 2025. On February 21, the Ministry of Industry and Trade issued a decision to temporarily impose anti-dumping tax (CBPG) on HRC steel from China at a tax rate of about 19% – 28%.

Accordingly, anti-dumping tax (CBPG) is considered a decisive factor in regaining market share of domestic enterprises in the context of fierce competition in the domestic market.

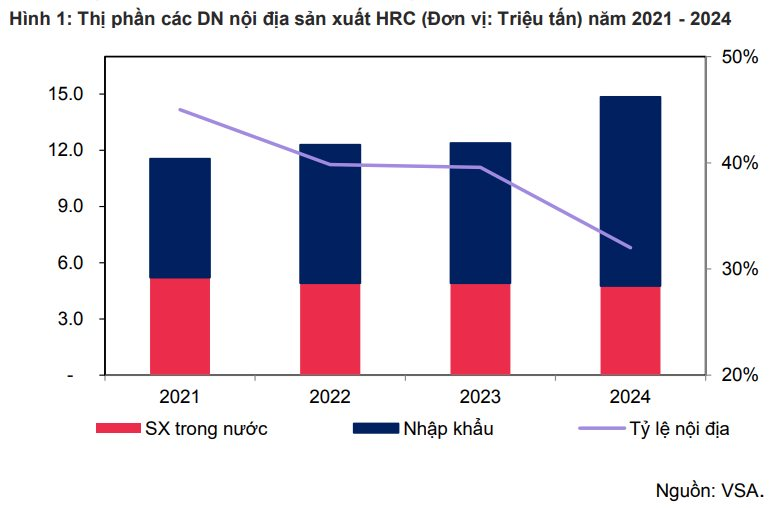

In 2024, imported hot-rolled steel (HRC) accounts for about 67% of domestic consumption, of which 75% comes from China. Steel demand in China is at its weakest level in the past five years, leading to domestic enterprises increasing exports to maintain production.

Therefore, HRC steel import output increased by 35% over the same period last year to reach 10.1 million tons, while output from domestic enterprises was about 4.8 million tons (down 3% over the same period last year).

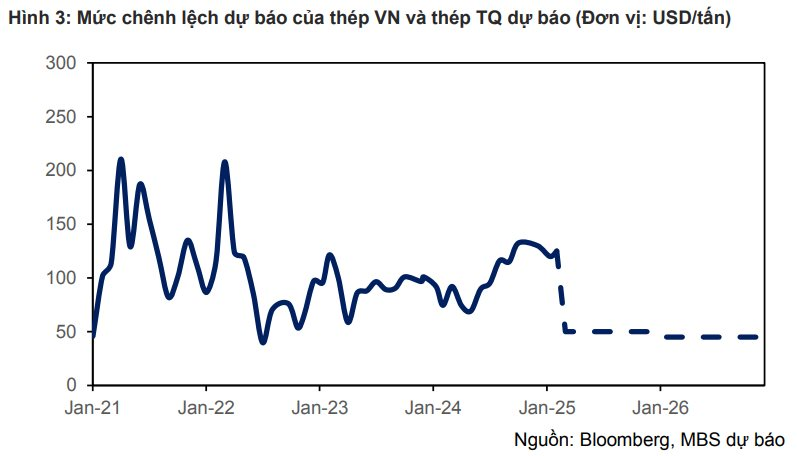

Steel imports to Vietnam have increased sharply in the context of a high price gap between Vietnam and China.

The gap in 2024 has increased to 110 USD/ton (up 30% year-on-year), so Vietnamese galvanized steel manufacturers prefer to use Chinese steel instead of domestic hot-rolled steel (HRC).

Due to the strong increase in supply, HRC prices in the year decreased by about 11% year-on-year to 530 USD/ton.

With the tax rate for most Chinese enterprises at 28%, MBS forecasts that the gap between Vietnamese and Chinese steel may decrease to 45 – 50 USD/ton (excluding costs such as transportation and storage).

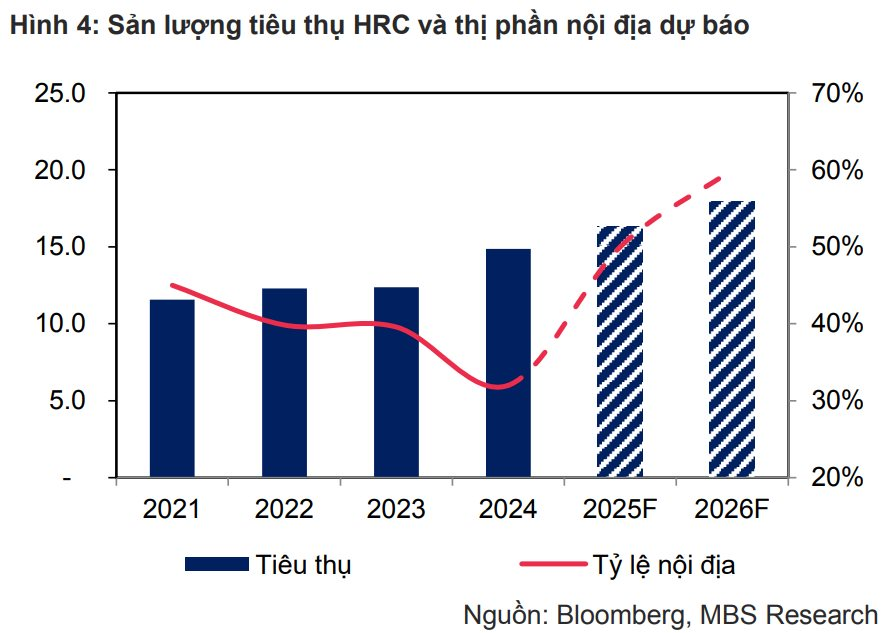

With the new gap, galvanized steel manufacturers can use domestic hot-rolled steel (HRC) instead of imports due to the advantages of transportation costs and delivery time. Thanks to that, MBS estimates that the domestic HRC market share could increase to 60% in the 2025-2026 period (compared to about 32% in 2024).

In addition, the demand for hot-rolled steel (HRC) is forecast to grow by 10% year-on-year in the 2025-2026 period to 16.3-17.9 million tons, driven by consumption of galvanized steel as well as other manufacturing industries such as automobile manufacturing. In addition, demand is expected to grow strongly after 2026 thanks to transportation projects such as the North-South high-speed railway.

With two key factors from the cooling pressure on Chinese steel prices and strong growth in demand, domestic HRC steel prices are forecast by MBS to recover from the second quarter of 2025 and reach 590/634 USD/ton (up 8%/9% year-on-year).

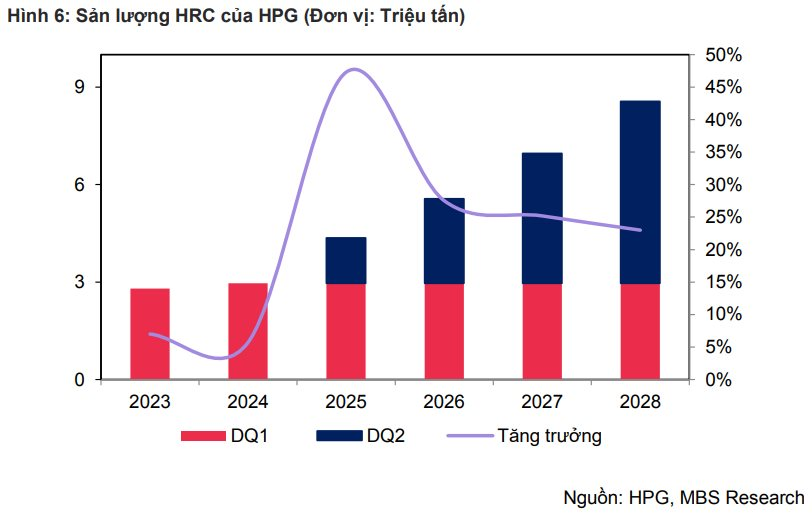

Hoa Phat (HPG) currently accounts for about 33% of total HRC consumption in 2024. The Dung Quat 2 factory of this group will start producing from the end of the first quarter of 2025.

MBS forecasts that the company’s HRC selling price and output in 2025 will grow by 8% and 47% respectively compared to the same period last year thanks to the contribution from Dung Quat 2 with about 1.4 million tons. Moreover, the time of anti-dumping tax application coincides with the completion time of Dung Quat 2 factory, which can have a positive impact on output in the long term by reducing competitive pressure from Chinese steel.

MBS forecasts that the factory will operate at 100% capacity in 2028 and contribute about 5.6 million tons, contributing to HRC output reaching 8.6 million tons (an increase of 187% compared to 2024).