USD exchange rate today 02/21/2025 on the world market

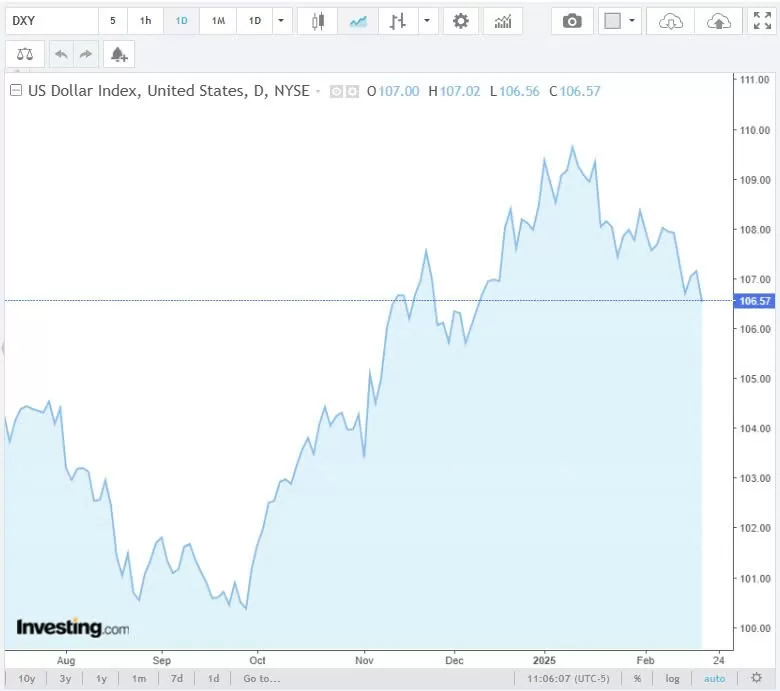

The Dollar Index (DXY), which measures the greenback against a basket of six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stood at 106.57, down 0.6 points from February 20, 2025.

The dollar fell against major currencies on Thursday as investors took stock of President Donald Trump’s latest tariff plan, while the yen rose to an 11-week peak on expectations that the Bank of Japan (BOJ) will continue to raise interest rates.

US data showing initial jobless claims, in line with expectations, and a report showing factory output growth slowed in the mid-Atlantic region in February had minimal impact on currency markets. The reports did not change expectations that the Federal Reserve will remain on hold for several months.

Tariffs, however, remain a major concern for currency investors, although their impact has now faded.

Trump said on Wednesday he would announce new tariffs next month or sooner, adding timber and forestry products to previously announced plans to impose duties on imported cars, semiconductors and pharmaceuticals.

“Forex markets are showing signs of fatigue when it comes to tariff headlines. While Trump’s rhetoric on tariffs will be the main driver of markets, investors are becoming more selective in their reaction to them given his changing position,” said Boris Kovacevic, global market strategist at Convera in Vienna.

“Trump has postponed some tariffs, which explains why equities in the US and Europe are hitting record highs and why the US dollar is down 3% from its January peak,” said Boris Kovacevic.

The dollar fell after data showed initial jobless claims rose 5,000 to a seasonally adjusted 219,000 in the week ended Feb. 15. Economists polled by Reuters had forecast 215,000 claims in the latest week.

A separate report also weighed on the greenback, showing the Philadelphia Federal Reserve’s monthly manufacturing index fell 26.2 points – the biggest drop in nearly five years – to 18.1 in February from 44.3 in January.

Meanwhile, the yen rose to an 11-week high against the dollar of 149.63 yen. The US currency most recently fell 1.2% to 149.68 yen, largely on concerns about Trump’s tariffs as well as growing expectations that the BOJ will raise interest rates further this year.

The euro also fell against the yen, down 0.8% to 156.68, while the yen gained 0.74%, on track for its biggest one-day decline in two weeks.

BOJ Governor Kazuo Ueda said on Thursday that he had met Prime Minister Shigeru Ishiba to exchange views on the economy and financial markets regularly.

Bank of Singapore currency strategist Moh Siong Sim said he did not think there was just one reason for the yen’s rise, but the news that Ueda and Ishiba did not discuss raising long-term interest rates could reassure markets.

Markets are also watching geopolitical developments after Trump called Ukrainian President Volodymyr Zelenskiy “a dictator” on Wednesday, deepening a rift between the two leaders that has worried European officials.

Trump’s comments that a new trade deal between the United States and China “maybe” were also being weighed by market participants. Trump also said on Wednesday that he expected Chinese President Xi Jinping to visit the United States, but did not say when.

“We’re seeing an impact from the Australian dollar and the New Zealand dollar, which are heavily exposed to China’s trade practices,” Pfister said.

The Australian dollar was last up 0.8% at $0.6392, also reacting to a mixed jobs report that showed jobs beat expectations in January for a second straight month, but the unemployment rate remained elevated.

The New Zealand dollar also rose sharply, up 0.9% to $0.5754.

The British pound also rose 0.4% to $1.2638.

USD exchange rate today 02/21/2025: USD depreciates due to pressure from tariffs; meanwhile, Yen appreciates due to BOJ betting on interest rate hike

At the time of survey at 4:00 a.m. on 02/21, the central exchange rate at the State Bank is currently 24,643 VND/USD, down 20 VND compared to yesterday’s trading session.

Specifically, at Vietcombank, the USD exchange rate is 25,320 – 25,710 VND/USD, up 10 VND in both buying and selling compared to yesterday’s trading session.

TPB Bank is buying USD cash at the lowest price: 1 USD = 24,390 VND

TPB Bank is buying USD transfers at the lowest price: 1 USD = 24,430 VND

HSBC Bank, OCB Bank are buying USD cash at the highest price: 1 USD = 25,410 VND

VietinBank is buying USD transfers at the highest price: 1 USD = 25,549 VND

TPB Bank is selling USD cash at the lowest price: 1 USD = 24,870 VND

VIB Bank is selling USD transfers at the lowest price: 1 USD = 25,525 VND

LPBank, OceanBank are selling USD cash at the highest price: 1 USD = 25,780 VND

MB Bank is selling USD transfers at the highest price: 1 USD = 25,780 VND